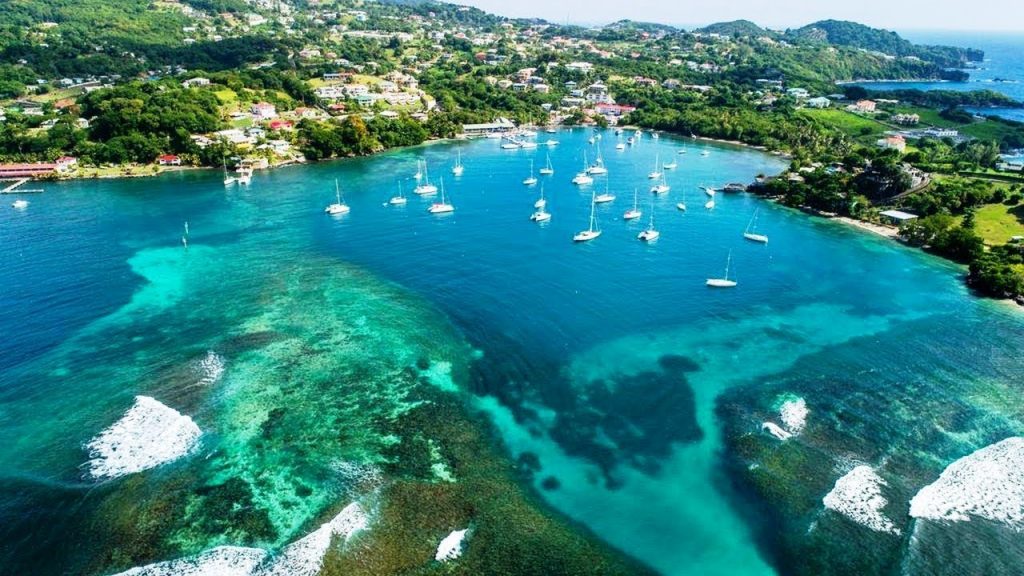

Saint Vincent and the Grenadines, which is often referred to as SVG is a popular offshore jurisdiction to incorporate a new business. Because St. Vincent offers favorable taxes and keeps all client information confidential, it is quite popular. Finally, it only takes a couple weeks to get started, so let’s get going with the process today!

How Do I Set Up a St. Vincent and Grenadines IBC Company?

First, our team will ensure that your desired entity name isn’t already taken

Once the name has been confirmed, we will then prepare all required registration forms and required documentation

After the company has been successfully registered, we’ll have the official documents sent via courier to your address

In addition to the company formation, we can also assist your business in establishing a bank account

Why St. Vincent and the Grenadines?

- All information is kept completely private

- No taxes to be paid

- A physical office or local directors are not required

- Speedy set up period

- Legal opinion also available at an added cost

Geneva Roth – Your Partner For Offshore Incorporations

Geneva Roth offers a complete solution for the establishment of company in St. Vincent. Due to our professionalism and industry expertise, we are the best partner for global business incorporation and bank account set ups. To start the application process, contact us today!

Contact Us!

To learn more about the set up process, fees, and other questions, don’t hesitate to contact us.

Dear Team Geneva Roth,

Hope you’re well. We are interested in setting up an International Business Company in St. Vincent and the Grenadines. We’d like to learn more about your services, the requirements to set up, and a few of the regulations around establishing an IBC in SVG.

The company we intend to set up will be primarily focused on making investments, and as such, we want to understand:

1. KYC requirements for our investors and ultimate beneficiaries

2. Bank account opening requirements for the IBC in SVG

3. Regulations around creating an investment company for crypto assets and whether there are separate regulations here

4. Director & residency/visit requirements

5. Cost of setting up and maintaining the company

If it is easier, we are more than happy to have a call with someone from your firm. Please let me know if there is a convenient time for you to speak next week (week of Monday 30th May)

Look forward to hearing back from you soon.

Best,

Rahul.